Contents

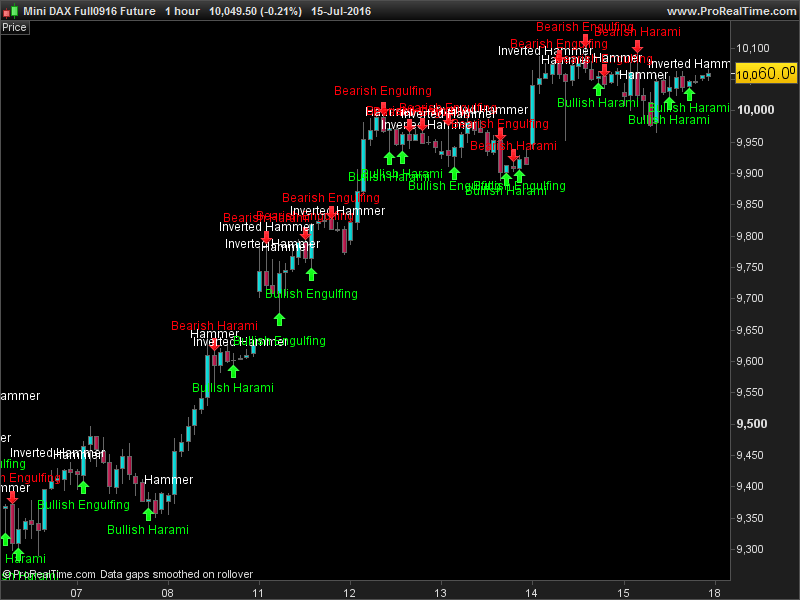

Driving comes naturally irrespective of which car you are driving. Likewise, once you train your mind to read the thought process behind a candlestick, it does not matter which pattern you see. You will know how to react and set up a trade based on the chart you are seeing. Of course, to reach this stage, you will have to go through the rigour of learning and trading the standard patterns. The ultimate goal is to understand and recognize that candlesticks are a way of thinking about the markets.

For instance, when the pattern appears near a strong resistance level, there is always a strong likelihood that the price will correct from the previous uptrend and move lower. The resistance level tends to attract more sellers to join the fray and help lower prices. A sign appears on the chart in front of the trader — the three rivers power patterns in price action pattern. The trader knows the chances of overcoming resistance is slim. The second candlestick is usually a small, bearish candlestick that affirms waning short-selling pressure. Finally, the third candle is the conformation candlestick.

Share this:

Sometimes the small patterns can form right before that breakout occurs and not being able to see that can hurt. Hence why you’re always hearing us say to find patterns within patterns. It’s so important to be able to see patterns within patterns.

More conservative traders could delay their entry and wait to see if price action moves lower. However, the drawback of this is that the trader could enter at a much worse level, especially in fast moving markets. However, it is essential to note that the frequently occurring evening star pattern might not provide accurate trading signals. Therefore, the prospect of a failed breakout is usually high.

The previous six days could be characterized as an uptrend, with the first day of the evening star pattern being a bullish candlestick. The second day gaps up and opens above the closing price of the first day. So far this is a continuation of the prior bullish uptrend. Morning star candlestick pattern forms at the base of a strong downtrend move.

Statistics to prove if the Evening Star pattern really works

Can provide a trader with an indicator for entry or exit point. The exact opposite of the same is a morning star pattern. The first part of an Evening Star reversal pattern is a large bullish green candle. On the first day, bulls are in charge – new highs are usually made.

The candlestick on day 2 is usually small and can be bullish, bearish or neutral. The scope of financial accounting is a type of reversal pattern of asset price charts. It usually appears at the top of an uptrend and is a bearish signal. Traders do not commonly see an Evening Star pattern, but it is a reliable indicator for technical analysis. Still, like many indicators, it was developed long before the emergence of cryptocurrencies and has been used in stock trading. A slight difference between using technical analysis tools in crypto and stocks is that the crypto market is more volatile.

- Even though the price hesitated to fall, but finally dropped.

- The bears are so eager to sell that they are willing to sell at a price lower than the previous day’s close.

- Even though it is very common among traders, there are other bearish signs as well.

- However, after some time, the evening star pattern emerges at the top affirming waning upward momentum.

- We research technical analysis patterns so you know exactly what works well for your favorite markets.

An Evening Star pattern consists of a long bullish candle, a “star” with a short body or nobody, and a bearish confirmation candle. Candlestick charts are the usual element of cryptocurrency exchanges. It showcases several characteristics of the asset on the market at the given moment, namely the open, high, low, and close prices. The price direction is usually expressed via green and red colors. Trading the Evening Star pattern will take practice and intuition because three candles look like the Evening Star pattern. We should understand the conditions and circumstances where it appears.

Then, at the price peak, there is a hollow candle or a candle with a short body. Then, the price goes down, and the next candles are red. The pattern where the short-body candle is preceded by red candles and followed by green ones is called a morning star pattern and serves as a bullish signal. The evening star pattern is pretty rare and trustworthy. Additionally, using moving averages to determine areas of strong resistance helps enhance the candlestick pattern’s ability to predict trend reversals.

How reliable is the Evening Star in Forex Trading?

A candle that has a long upper shadow precedes the pattern. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz.

When evaluating online brokers, always consult the broker’s website. Commodity.com makes no warranty that its content will be accurate, timely, useful, or reliable. Mr. Pines has traded on the NYSE, CBOE and Pacific Stock Exchange. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives. Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts.

There should be a gap up from the first candle to the star in an ideal Evening Star pattern. It means that the open price increased rapidly from the preceding close price with very few or even no transactions happening in the meanwhile. A morning star is a bullish candlestick pattern in a price chart. It consists of three candles and is generally seen as a sign of a potential recovery following a downtrend. The evening star pattern is considered a reliable indicator that a downward trend has begun. However, it can be difficult to discern amidst the noise of stock-price data.

Typically with a gap down from the preceding star, the third candle is bearish, with the close price lower than the open price. The upward trend shown in the first candle has been reversed, and the price gain has been eliminated. This candle confirms the Evening Star pattern and gives a selling signal. These are the tell-tale signs that an evening star pattern has occurred. Technical analysts trading this security would consider selling or shorting the security in anticipation of an upcoming decline. An evening star contains a middle candlestick that peaks between two other candles by gaping up the first one and then gaping down the third session.

While the evening star is a popular trend reversal signal for short sellers, bulls also use it to exit the market and lock in profits after a significant move higher. The second one is a small-bodied candlestick that can be bearish or bullish but does not touch the body of the first candlestick. Finally, the third one is a large bearish candlestick that affirms the momentum shift from bullish to bearish. Because you cannot cosider the pattern as valid until it completely appears on the chart.

What does the Morning Doji star mean?

While the morning version of the pattern includes an intermediate candlestick that gaps down the first day and then gaps up the third one. Third, a bearish candle that closes downer the middle point of the first candlestick. To explain, the last candle holds a strong reversal signal. Second, a little candle implies that buyers are losing exchange control.

Even for risk takers it would be prudent to wait for a confirmation. Think about it, the whole of candlestick patterns is actually based on price action and the markets reaction to it. We should give time for the price action to pan out. Hence for both risk takers risk averse traders it would make sense to wait proportionately ..before initiating a position.

To help identify it reliably, traders often use price oscillators and trendlines to confirm whether an evening star pattern has in fact occurred. Detecting the evening star pattern on time is not an easy task. The elements of this pattern can go unnoticed in an overwhelming crypto market data flow. To increase the chances of timely detection of this pattern, you can use such tools as price oscillators, trendlines, etc. To prevent false positive evening star pattern detection, you should confirm the pattern formation via other indicators and analysis tools. If your assumptions about the alleged evening star pattern contradict the predictions you got using other tools, the evening star is probably not taking place.

The pattern forms in the sideways price range, while the https://1investing.in/ forms in the bullish trend. Unlike the head and shoulders pattern, the triple top pattern has all tops around the same level. The evening star pattern can be a part of the triple top pattern.

Top Reversal Candlestick Patterns

The Profit Target can be set near previous consolidation areas. Whereas, Stops can be set below the most contemporary swing down created by the pattern. Because the reversal invalidates when the currency pair breaks this grade. Consequently, you may accumulate losses if you do not place stops. In short, trading the morning star candlestick pattern in the forex market requires a sound money management plan.

َAbonnez-vous

َAbonnez-vous